This tax season, keep your refund safe and stay in control of your money. Use these 6 tips to protect yourself from scams. And if you haven't already, consider getting a Providers Card mobile banking account. Keeping your money secure and your information private is our top priority.

If you think your card has been stolen or compromised, make sure to lock your card to prevent any more unauthorized transactions and keep your money safe in the "Money" section of our app under "Manage Cards." And then don't hesitate to contact Providers customer support directly at (877) 404-4137.

1. Think twice about texts, calls, emails, and DMs

Think before you act if you get a text, phone call, email, or social media DM asking you for personal information. Scammers may:

- Pretend to be from a company you know

- Ask you for your account details, like your account number

- Say there’s a problem with your account or a prize to claim

- Pressure you to act fast

If you get an unexpected message or call, don’t click on suspicious links or give out your information. Providers will never ask you for your EBT or mobile banking account information over text or social media. If you’re in doubt, call our customer support team and ask if the request for information is real.

2. Protect yourself when using payment apps

Mobile payment apps like CashApp, Venmo, and PayPal make it easy to send money to friends and family. Make sure that you only send money to people and businesses you know. If you're using a payment app to buy something, make sure the seller is using a business account. Otherwise, you might not be eligible for a refund.

3. Watch out for tax scams

During tax season, scammers may contact you pretending to be the IRS. Stay one step ahead of them and keep your information secure. The IRS will never initiate contact with you by email, text message, or social media message. Instead, they'll usually send you a letter in the mail. Learn more about how to know if it's really the IRS contacting you or if it's a scam.

4. Keep your ATM PIN private

Choose an ATM PIN that only you'll know. Avoid obvious choices, like “1111,” “1234,” or your birthday. Never tell anyone your PIN, and never write it down on your card or in your wallet. Providers won't ask you for your PIN. If you get a call or text asking you for it, that's a scam.

5. Stay in control with instant transaction notifications

If you have a Providers Card mobile banking account, you can get instant notifications about all of your transactions. If a transaction doesn't seem right, you'll catch it as soon as it happens. To opt into Providers Card notifications:

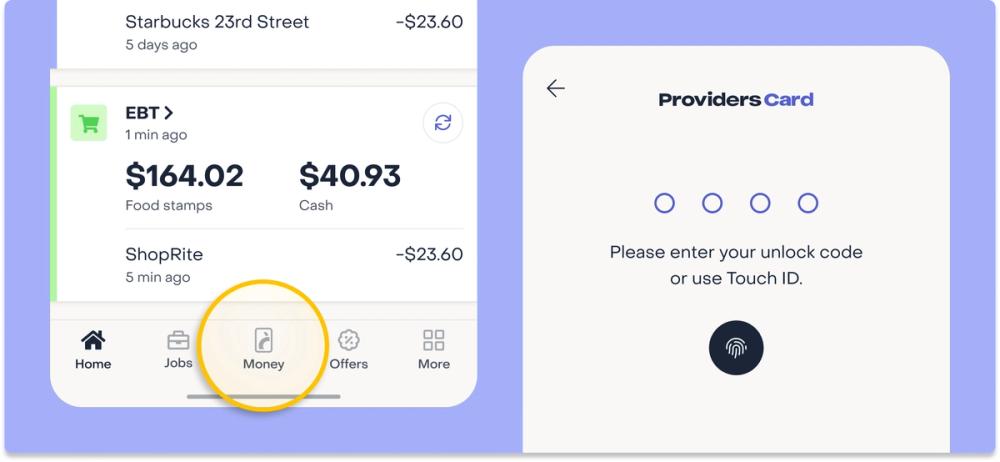

1. Open the Providers app

2. Tap the "Money" icon in the center of the bottom navigation bar

3. Enter your unlock code

4. Scroll to the bottom of the page

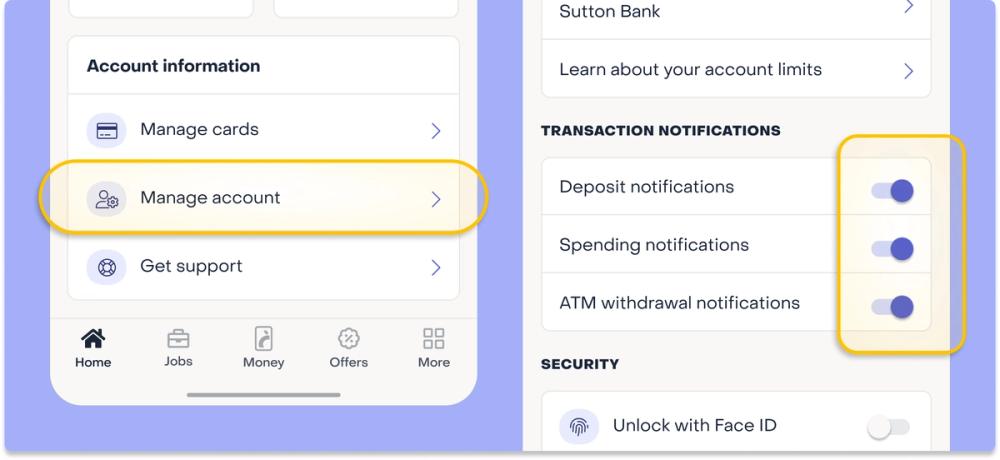

5. Tap “Manage account” under "Account Information"

6. Under “Notification Settings,” toggle all notification settings to the right (they'll be purple) You'll now get deposit notifications, spending notifications, and ATM withdrawal notifications

6. Lock your debit card

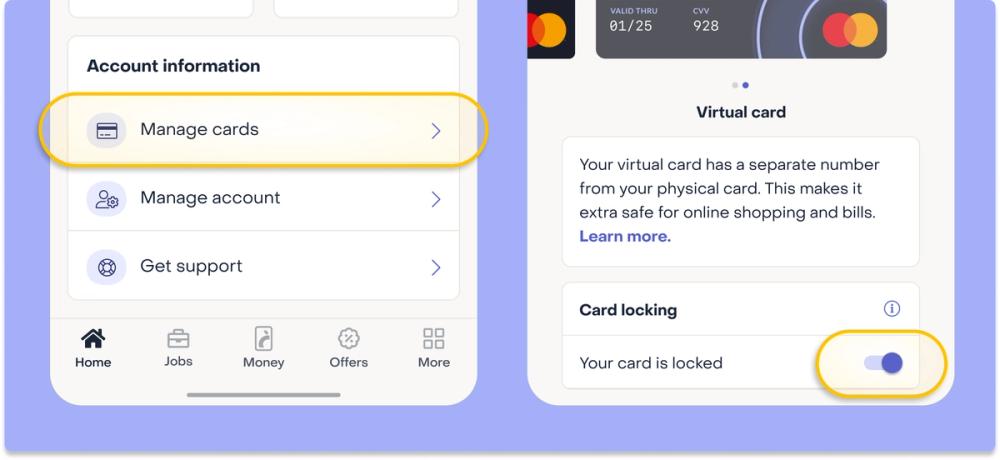

When you're not using your virtual or physical Providers Cards, you can lock them. That way, no one can use them to make purchases. It takes just a second to unlock your cards when you're ready to use them again. To lock or unlock either of your cards:

- Open the Providers app

- Tap the "Money" icon in the center of the bottom navigation bar

- Enter your unlock code

- Scroll to the bottom of the page

- Tap “Manage account” under "Account Information"

- Choose whether you want to lock or unlock your physical card, virtual card or both by swiping on the card images

- Under “Card locking,” move the toggle to the right to lock your card, and move it to the left to unlock your card. If your Providers Card is lost or stolen, lock it right away. Then request a new one in the Providers app.

Want to get a Providers Card? Download the Providers app, link your EBT card, and sign up for Providers Card mobile banking today.